Your credit score is a crucial factor in determining your financial future. It plays a significant role in your ability to secure loans, credit cards, and even rental agreements. Understanding how credit scores work and knowing how to improve them is essential for your financial well-being.

So, let’s delve into what exactly a credit score is and how it is calculated.

What is a Credit Score?

A credit score is a three-digit number that provides an estimate of your creditworthiness. It reflects your ability to repay borrowed money and pay bills on time. Lenders and creditors use your credit score to assess the risk of lending to you and determine the terms and interest rates they offer.

Your credit score is calculated based on information from credit-reporting agencies such as Equifax, Experian, and TransUnion. These agencies collect data about your credit accounts, including your payment history, credit utilization, length of credit history, and recent credit applications.

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Understanding the credit score range chart can help you determine where you stand and what steps you can take to improve your score.

What factors affect your credit score?

Several factors influence your credit score. Payment history is one of the most significant factors, accounting for about 35% of your score. Making timely payments on your loans and credit cards demonstrates responsible financial behavior and can positively impact your score.

Credit utilization, which refers to the amount of available credit you’re using, also plays a role. Keeping your credit card balances low compared to your credit limits can help improve your score. The length of your credit history, credit mix (having a variety of credit accounts), and recent credit applications also contribute to your credit score.

By understanding these factors and their impact on your creditworthiness, you can take steps to improve your credit score and increase your chances of obtaining favorable lending terms.

The difference between FICO score and VantageScore

When it comes to understanding your creditworthiness, it’s important to know the difference between your FICO score and VantageScore. While both scoring models use a credit score range of 300 to 850, there are some variations in how they calculate your credit score.

FICO score: The FICO score is the most commonly used credit scoring model in the United States. It takes into account multiple factors, including payment history, credit utilization, length of credit history, credit mix, and recent credit applications. FICO scores are used by many lenders to assess your creditworthiness and determine the interest rates and terms they offer you.

VantageScore: VantageScore is a newer credit scoring model developed by the three major credit bureaus (Equifax, Experian, and TransUnion). Like FICO, it considers factors such as payment history, credit utilization, credit mix, and recent credit behavior. However, VantageScore may weigh these factors slightly differently than FICO, resulting in potential variations in your credit scores.

It’s important to note that while your FICO and VantageScore credit scores may differ slightly, they are both reliable indicators of your creditworthiness. Understanding these differences can help you better interpret your credit scores and make informed decisions about your financial future.

Factors that Impact Your Credit Scores

Your credit scores are influenced by several factors that lenders and credit reporting agencies consider when assessing your creditworthiness. Understanding these factors can help you make informed decisions that positively impact your credit scores.

Credit History

One of the most significant factors that affect your credit scores is your credit history. Lenders want to see a track record of responsible borrowing and repayment. A longer credit history indicates stability and gives lenders more information to evaluate your creditworthiness. On the other hand, a limited credit history or a history of missed payments can negatively impact your scores. It’s crucial to make consistent, on-time payments and avoid defaulting on any credit obligations.

Credit Mix

The variety of credit accounts you have, such as credit cards, loans, and mortgages, also plays a role in determining your credit scores. Having a diverse credit mix demonstrates your ability to manage different types of credit responsibly. It shows that you can handle both revolving credit (credit cards) and installment loans (car loans, mortgages). However, it’s important to note that you should only take on credit that you can manage and not overextend yourself.

In addition to credit history and credit mix, other factors like credit utilization (the amount of available credit you’re using), length of credit history, recent credit applications, and the presence of any negative information (such as bankruptcies or collections) can impact your credit scores. By understanding these factors, you can take proactive steps to improve your creditworthiness and maintain a healthy credit profile.

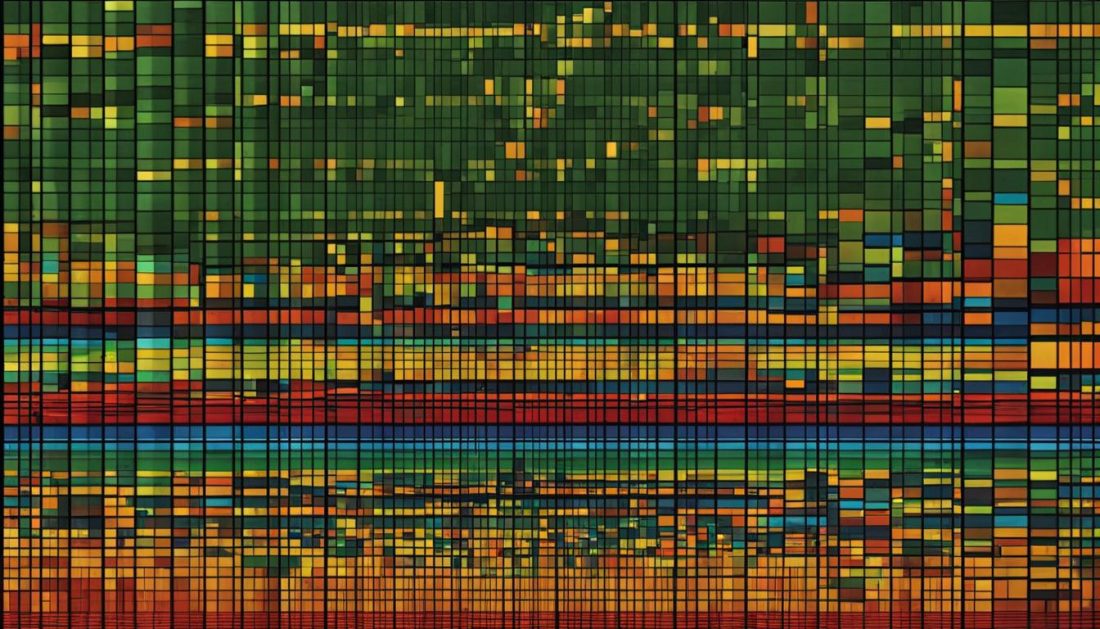

Credit Score Ranges

Understanding the credit score ranges is essential in evaluating your creditworthiness. Creditors have their own standards for accepting scores, but it’s helpful to know the general credit score ranges used by the most widely used scoring models.

For the FICO scoring model, credit scores are categorized as follows:

- Below 580: Poor

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very Good

- 800 and above: Exceptional

The VantageScore model has slightly different credit score tiers:

- 300 to 600: Subprime

- 601 to 660: Near Prime

- 661 to 780: Prime

- 781 to 850: Superprime

Maintaining a good credit score range, such as a FICO score of 670 or above, increases your chances of getting approved for credit and receiving favorable interest rates.

What is a Good Credit Score Range?

A good credit score range generally falls within the “good” or “prime” categories of the respective scoring models. For FICO, a good credit score range would be 670 to 739, while for VantageScore, it would be 661 to 780. These scores indicate that you have demonstrated responsible credit management and are considered less risky to lenders.

Having a good credit score range gives you access to better loan terms, lower interest rates, and a wider range of credit options. It’s important to remember that maintaining a good credit score range is an ongoing process that requires responsible financial habits and proactive credit management.

Conclusion

In conclusion, understanding credit score ranges is crucial for assessing your creditworthiness. The FICO and VantageScore models have their own credit score tiers, and maintaining a good credit score range is essential for accessing favorable credit terms. By practicing responsible financial habits and monitoring your credit regularly, you can start or continue building a strong credit history.

How to Improve Your Credit

Improving your credit score is essential for securing better financial opportunities. By taking proactive steps and making responsible financial decisions, you can work towards improving your creditworthiness. Here are some strategies to help you improve your credit score:

Pay Bills on Time

One of the most crucial factors in improving your credit score is making timely payments. Paying your bills on time demonstrates your reliability as a borrower and shows lenders that you can manage your debts responsibly. Set up reminders or automatic payments to ensure you never miss a due date.

Keep Credit Card Balances Low

Your credit utilization ratio, which is the amount of credit you’re using compared to your credit limit, plays a significant role in your credit score. Aim to keep your credit card balances low and avoid maxing out your cards. Ideally, you should aim to use less than 30% of your available credit.

Monitor Your Credit

Regularly monitoring your credit is essential to track any changes and identify potential issues. You can obtain a free credit score from various personal finance websites or through your banking apps. Monitoring your credit allows you to catch any errors or discrepancies and take appropriate action.

These are just a few steps you can take to improve your credit score. By being proactive and responsible with your financial habits, you can gradually raise your creditworthiness and open doors to better financial opportunities.

Establishing or Building Your Credit Scores

Building a strong credit history is essential for securing loans, credit cards, and favorable interest rates. Whether you’re starting from scratch or rebuilding your credit, there are several steps you can take to establish and improve your credit scores.

If you’re new to credit, consider opening an account that reports to the credit bureaus, such as a credit builder loan. These loans are specifically designed to help individuals build credit and establish a positive payment history. Another option is to apply for a secured credit card, where you provide a cash deposit that serves as your credit limit. By making timely payments and keeping your balances low, you can showcase responsible credit behavior.

For those with limited credit history, becoming an authorized user on someone else’s credit card can be beneficial. This allows you to piggyback on their positive credit history and can help improve your own scores. Additionally, services like Experian Boost allow you to add positive payment history from utility bills and other sources to your credit report, further strengthening your credit profile.

Regardless of your situation, it’s important to practice good credit habits. Make all payments on time, avoid maxing out credit cards, and maintain a reasonable credit utilization ratio. With time and responsible credit management, you can establish a solid credit foundation and increase your creditworthiness.

How Long Does It Take to Rebuild a Credit Score?

Rebuilding a credit score is a process that varies for each individual based on their unique credit situation. While there is no specific timeline, taking proactive steps to improve your credit can help expedite the process. Making on-time payments and bringing past-due accounts current are crucial steps in rebuilding credit. It’s important to note that negative marks on your credit report, such as late payments or collections, will typically fall off after seven years, gradually reducing their impact on your credit score.

In addition to rectifying past credit issues, you can accelerate the rebuilding process by adding positive information to your credit report. This can be done by responsibly managing new credit accounts, such as credit cards or loans, and ensuring timely payments. Demonstrating a track record of responsible credit usage over time will help improve your creditworthiness.

While rebuilding a credit score requires patience and consistent financial habits, it’s essential to monitor your progress along the way. Regularly checking your credit score and credit reports can help you track changes, identify any potential errors, and ensure that you’re on the right track to rebuilding your credit. By staying proactive and taking the necessary steps to improve your credit, you can work towards achieving a better credit score and financial stability.

How to Check and Monitor Your Credit

If you want to stay on top of your credit health, it’s essential to regularly check and monitor your credit. By doing so, you can keep track of changes, detect any potential errors or fraudulent activity, and take necessary steps to protect your creditworthiness. Fortunately, there are convenient ways to check and monitor your credit for free.

To check your credit score: You can use personal finance websites like NerdWallet or access your credit score through your personal banking apps. These platforms provide a quick and easy way to view your credit score without any cost. It’s a good practice to check your credit score at least once a year or before making any significant financial decisions.

To monitor your credit: Freezing your credit with each credit bureau is a proactive step to protect your credit information from unauthorized access. It adds an extra layer of security by preventing anyone from opening new accounts in your name. Additionally, you can sign up for credit monitoring services that alert you to any changes or suspicious activity on your credit report.

Monitoring Made Easy

By regularly checking and monitoring your credit, you can take control of your financial well-being. It empowers you to spot potential issues early on and take appropriate action to resolve them. Remember, a vigilant approach to your credit can lead to greater financial security in the long run.

Credit Education Resources

When it comes to managing your financial well-being, credit education is crucial. Fortunately, there are various credit education resources available to help you navigate the complexities of credit and make informed decisions.

One valuable resource is articles. Many websites and financial publications offer insightful articles that cover a wide range of credit-related topics. These articles can provide you with valuable tips, strategies, and up-to-date information to help you understand credit better.

Webinars are another excellent credit education resource. Organizations and financial experts often host webinars where they dive deep into various credit-related subjects. Attending these webinars can give you the opportunity to learn from industry professionals and gain a better understanding of credit management.

If you need more personalized guidance, credit counseling services can be an invaluable resource. These services typically offer one-on-one sessions with credit experts who can assess your specific financial situation, provide tailored advice, and help you create a plan to improve your credit health.